Australis Oil & Gas is set for its best trading day in history, fueled by a landmark partnership with a major U.S. oil and gas company. The move has sent shockwaves through the energy sector, signaling a major leap forward for the company’s ambitious development plans.

What Happened

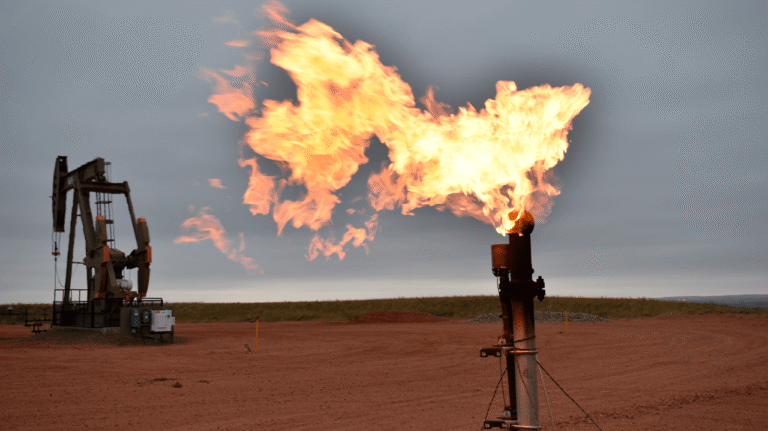

Australis Oil & Gas has finalized a strategic partnership with a prominent U.S.-listed independent oil and gas company to advance drilling and development across its undeveloped Tuscaloosa Marine Shale (TMS) acreage. The deal brings a massive influx of capital and technical expertise, positioning Australis to accelerate its growth trajectory.

In a parallel transaction, Australis has also sold a significant stake in its existing TMS producing wells. This move will retire all outstanding debt and inject fresh liquidity into the company, giving it a robust financial foundation to pursue future opportunities.

Why It Matters

The partnership validates the commercial potential of the TMS play and demonstrates strong market confidence in Australis’s assets. With a U.S. partner at the helm, the company is now poised to unlock the full value of its undeveloped acreage, leveraging both financial and technical resources to drive value creation.

The combination of carried development funding, strengthened liquidity, and retained operatorship gives Australis a clear and funded path forward. Shareholders can expect accelerated progress on drilling and development, with the potential for significant upside as the TMS project advances.

Market Reaction

The news has triggered a surge in Australis’s share price, with the company on track for its best trading day ever. Investors are responding positively to the clarity and momentum provided by the new partnership and financing arrangements.

Key Details

The U.S. partner will deploy up to approximately A$70.4 million under a Carry Program, funding Australis for a 20% working interest to earn an 80% interest in undeveloped operated acreage and part of the company’s non-operated holding. Australis will retain operatorship during the carry phase, ensuring continued control over the development program.

The sale of 90% of Australis’s working interest in existing TMS producing wells will provide roughly A$25.9 million in proceeds. This transaction will allow Australis to retire all outstanding debt and preserve its undeveloped acreage for the new partnering arrangement.

Under the agreement, the partner will assume operatorship of the producing wellbores following closing, with Australis retaining a 10% interest and participation rights under existing operating agreements.

What Comes Next

Australis is now positioned to pursue its longer-term development goals with a strengthened balance sheet and aligned partners focused on value creation. The company’s shareholders have a clear and funded way forward to advance the TMS, supported by partners with the financial and technical capacity to move the play forward.

The partnership and financing transactions mark a transformative moment for Australis, setting the stage for accelerated growth and value realization in the coming years.

The future looks bright for Australis Oil & Gas as it embarks on this new chapter, with the potential for significant milestones and value creation on the horizon.