Northern Oil and Gas (NOG) continues to reinforce its position as a leading non-operated upstream energy asset owner in the United States through strategic acquisitions and strong financial performance. Its recent updates highlight significant acquisitions alongside improving production metrics and noteworthy financial stability, underlining the company’s growth trajectory and strategic capital allocation in 2025.

## Strategic Acquisitions Bolstering Asset Portfolio

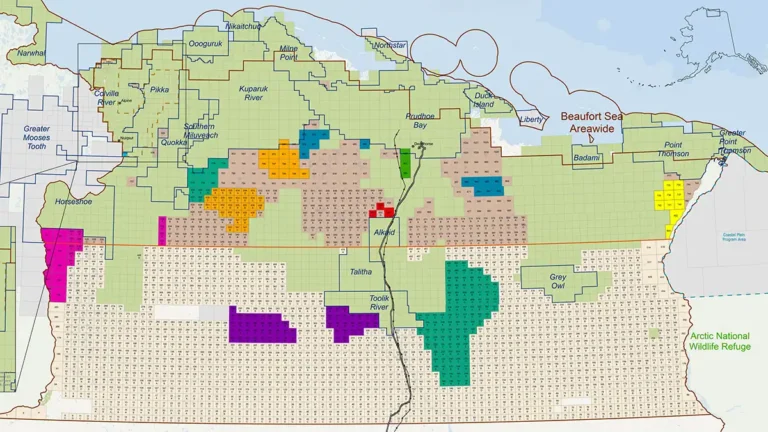

Northern Oil and Gas has actively expanded its asset base via multiple key acquisitions during 2025, which reflect its focused growth strategy in core basins. In the first quarter, NOG completed seven transactions acquiring a total of 1,015 net acres, utilizing various acquisition structures that demonstrate its flexible and opportunistic approach. A significant bolt-on acquisition in August added approximately 1,000 net royalty acres in the Uinta Basin, Utah, for $98.3 million in cash. This latest purchase primarily encompasses Duchesne and Uintah Counties and includes some 8,000 royalty acres standardized to 1/8th royalty interest.

This Uinta Basin acquisition is especially impactful, as it adds over 400 gross drilling locations and enhances NOG’s average net revenue interest (NRI) from 80% to 87% across its Uinta portfolio. The acquired properties are expected to produce about 900 barrels of oil equivalent per day (boe/d) in 2026, predominantly oil (over 85%), with the anticipation of steady production growth and minimal capital expenditure requirements going forward. These acquisitions not only expand the acreage and inventory under NOG’s control but also augment its royalty and working interest assets, which are central to its non-operated investment model.

## Robust Production Performance and Operational Efficiency

Northern Oil and Gas’s recent operating results affirm its capability to convert strategic acquisitions into tangible production growth. In Q1 2025, the company reported total production of 12.1 million barrels of oil equivalent (MMBoe), a 12% increase compared to the same period in 2024. Oil production rose by 11% to 7.1 million barrels, while natural gas production climbed 13%, reflecting effective integration of new assets and ongoing development activities. Average daily production similarly increased, with oil averaging nearly 78,700 barrels per day, and combined Boe averaging approximately 135,000 barrels daily.

Capital expenditures remain focused on organic drilling and development, with over $245 million invested in Q1 2025, complemented by incremental spending on acquisitions and related development costs. NOG’s strategic focus on low-cost, high-efficiency operations is reflected in its low cash general and administrative expense of $0.89 per Boe in Q2 2025, indicating prudent cost management. This efficiency underpins the company’s ability to deliver strong returns on capital employed (ROCE), which stood at an impressive 19.6% during the same period.

## Financial Health and Capital Structure

Northern Oil and Gas maintains a balanced financial profile characterized by steady cash flows and a well-managed capital structure. The company’s total shareholder equity and debt are roughly equal at around $2.4 billion each, resulting in a debt-to-equity ratio near 98%. Although this level of leverage is relatively high, it reflects NOG’s strategic use of debt to finance growth while maintaining operational flexibility.

The company’s earnings before interest and taxes (EBIT) coverage ratio of 6 times indicates strong ability to meet interest obligations, supported by operating cash flows covering 61% of net debt. Short-term assets of approximately $588 million exceed short-term liabilities, ensuring liquidity for immediate operational needs, even though long-term liabilities exceed short-term assets.

Recent transactions have been financed through a mix of available cash, free cash flow, and borrowings under revolving credit facilities, demonstrating disciplined capital deployment. NOG also completed a private offering of senior notes totaling $725 million in 2025, further strengthening its liquidity position and supporting ongoing acquisition and development activity.

## Strategic Outlook and Market Position

Northern Oil and Gas’s business model as a non-operated partner enables it to leverage its strong technical and data-driven capabilities to identify and acquire attractive upstream assets without the operational complexities or capital demands of operatorship. Its asset diversification across multiple prolific basins—including Williston, Uinta, Permian, and Appalachian—provides resilience against market volatility and commodity price fluctuations.

The company remains committed to increasing profits per share through disciplined capital allocation, strategic hedging, and continued portfolio optimization. With a proprietary data infrastructure analyzing over 10,000 wells and multiple operators, NOG is uniquely positioned to forecast well economics and execute accretive acquisitions. This approach aims to drive sustainable shareholder value even amid commodity price cycles and industry challenges.

## Conclusion

Northern Oil and Gas’s recent strategic acquisitions and strong financial metrics exemplify its dynamic growth strategy and operational discipline. By expanding its acreage and royalty interests, growing production efficiently, and managing a balanced capital structure, NOG solidifies its status as the premier publicly traded non-operated upstream energy asset owner in the U.S. As the company moves forward, its ability to integrate new assets with consistent operational execution will be key to delivering long-term value for investors and maintaining its competitive edge in a complex energy landscape.